[Interview] “A Company within a Company” Achieves 100 Billion Won in Sales: The Secret Behind Leading Adult Education’s Success in Japan

CEO Kangmin Lee of Day1Company and CEO Donghyuk Kim of Coloso CIC

Three Years of a Four-CIC Structure… Avoiding Corporate Stagnation and Embracing Competition to Fuel Growth

Differentiation in Japan’s Offline-Driven Market by Positioning as “Experts for Experts

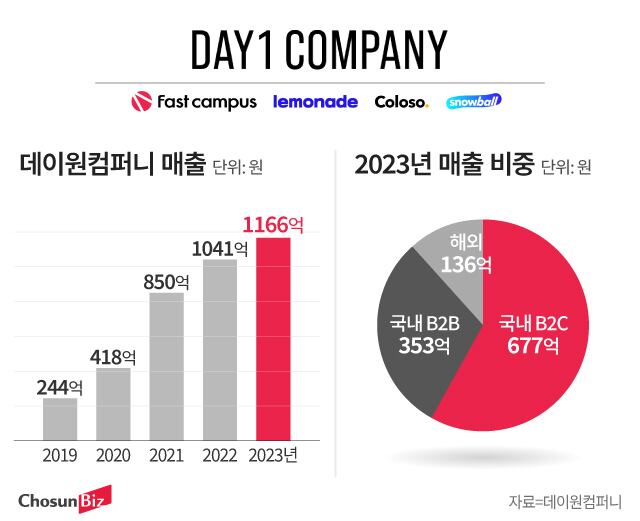

August 5, 2024 – Day1Company, a leading adult education provider in Korea, reported its highest revenue to date last year, reaching 116.6 billion won while turning profitable. The company attributes its success to the Company-In-Company (CIC) system introduced in 2021.

Founded in 2013 as an internal venture of Fast Track Asia, Day1Company began using the brand name “FastCampus” in 2014 before rebranding to its current name in 2021.

Simultaneously, the company restructured its business units—FastCampus, Lemonade, Coloso, and Snowball—into CICs, promoting each business unit head to CEO. Each CIC leader was given full autonomy over management, from strategic decision-making to business direction. As a result, the company surpassed the 100 billion won revenue mark starting in 2022.

Notably, Coloso CIC drove the company’s growth by generating 13.6 billion won in overseas sales in 2023. Coloso offers online lectures from top industry experts in various fields, including hair styling, cooking, and illustration. These experts, who are difficult to meet in person, share their practical experiences rather than theory.

Following its success in Japan and the U.S., Coloso launched a global platform earlier this year, offering content not only in English but also in Taiwanese and Spanish, serving customers in over 20 countries. In March, as part of its global expansion strategy, Coloso established a branch in Marunouchi, Tokyo, and hired product planners and marketing staff for local original content development.

On August 1, I sat down with Kangmin Lee, CEO of Day1Company, and Donghyuk Kim, CEO of Coloso CIC, at the company’s headquarters in Gangnam, Seoul. Lee explained that the CIC system was implemented three years ago to maximize each business unit’s performance and to prevent the “corporate disease” that can come with scaling up. The system’s success is reflected in the company’s increased sales, with Coloso CIC’s performance in the global market serving as a motivator for the entire organization.

─ Introducing the CIC system is quite striking.

Kangmin Lee (hereafter referred to as Lee): “In the education industry, various business models can be created. While the expertise in teaching specific fields, like mathematics, remains the same, there are many ways to deliver it—whether through video or one-on-one sessions. As more business models emerge, the structure, personnel, and operation methods required for each model differ. For instance, improving services to increase completion rates at Coloso doesn’t make sense. Coloso’s core value is selling the know-how of people, which is far from that kind of approach. While it may seem inefficient, it’s far simpler than constantly coordinating the four business divisions.

Another reason is to prevent ‘corporate disease.’ As the company grew, we found that working on one project often meant worrying about other projects. For example, if Coloso expands rapidly with illustration courses, FastCampus might also want to offer illustration courses, leading to a need for coordination to assign the task to just one team. This would negatively affect the motivation of each division’s CEO. Each division should focus on maximizing its own performance and envisioning a better future, but if a strange rule emerges like ‘FastCampus is handling it, so we can’t,’ it disrupts progress. By making each division an entirely independent organization and allowing competition when necessary, I believed we could sustain business growth.”

─ Many companies today are struggling due to the complex economic downturn, and the competition in the adult education market is also fierce.

Lee: “The corporate education (B2B) market may be somewhat affected. When the economy worsens, companies naturally cut back on training budgets. However, the consumer (B2C) market is quite resilient. In prosperous times, asset returns may outpace earned income, making personal development less of a priority. But now, increasing earned income has become far more important. For example, when the economy is strong, people may look for courses like ‘How to Build 2 Billion Won in Assets Through Real Estate Auctions.’ But these days, they are more likely to seek courses like ‘Earning as Much as Your Salary Through Real Estate Auctions.’ The challenges in B2B can be offset by B2C, so overall, there isn’t much impact from economic fluctuations. Many adult education service providers are competing to meet the desire for ‘finding a better-paying job’ or ‘moving to a better workplace.’ However, each company has its own approach to solving this issue. The key is being able to supply the education services that the market demands.”

─ FastCampus CIC, which can be seen as the company’s predecessor, and Coloso CICappear similar at first glance.

Lee: “The target audiences are similar, but the way we view and interpret the business is completely different. FastCampus is focused on what kind of education the market currently demands and how to plan and deliver that education in an appealing way. It’s less about the instructor and more about the subject of the lecture. Coloso, on the other hand, emphasizes the expertise and know-how of the instructor themselves. Therefore, we highlight the instructor’s career and personal story.”

Kim said, “We offer unparalleled content by positioning ourselves as ‘experts of the experts.’”

─ What do you think is the key to Coloso’s rapid success in the Japanese market?

Donghyuk Kim (hereafter referred to as Kim): “Coloso’s competitive edge lies in creating content that can be distributed globally, featuring instructors who set us apart from other companies. This includes topics like K-beauty or K-culture, where Korea has a natural advantage, as well as subjects like illustration, which are not tied to any particular country. After about a year of building up our content, we noticed demand from overseas buyers. Around 5% of our total traffic now comes from Japan and the U.S. On average, our content is priced at around 200,000 KRW (about $150), with some content costing over 1 million KRW (about $750). There aren’t many countries where people are willing to pay 200,000 KRW for 5 to 10 hours of content, but we’ve confirmed that the demand is coming from these markets.

When we first entered Japan, we began by translating our existing content into Japanese. Since establishing a branch in Marunouchi, Tokyo, this past March and hiring local staff, we’ve focused on planning and marketing original, locally-produced content.”

─ Were there no local competitors?

Lee: “Japan still has a culture where learning happens gradually, primarily through offline channels. Educational programs are divided into beginner, intermediate, and advanced levels, and online education is mainly used as a supplement to offline learning. Coloso’s approach is ‘results-oriented.’ We present the best outcomes from top experts and then explain how they achieved those results. As far as we know, there isn’t yet a service in Japan that offers content in this way.”

─ It must be challenging to continually recruit top-tier talent.

Kim: “It’s not easy, as we spent a year trying to bring on someone like Hirokazu Koreeda, whom you could call the ‘Japanese Bong Joon-ho.’ We met with him every three months to discuss ideas before finally securing the contract. He’s the director who won the Palme d’Or, the top prize at the Cannes Film Festival in 2018.

However, most renowned figures have schedules booked for over a year, and it’s difficult even to arrange a meeting. Moreover, these individuals don’t do lectures for the money. You need to identify what they want and satisfy those needs in order to improve the chances of securing them when you make a proposal.

At the same time, we determine which category of lectures we want to create, interview about 100 people, and receive recommendations for experts suited to the content. From this process, a shortlist is made, typically consisting of ‘experts of experts’—people who are well-regarded in their field but not widely known to the public. This approach increases our chances of success when reaching out to them.”

─ What challenges does Day1Company face?

Lee: “We’re also interested in the senior market. Education is essential for those looking to create income after retirement. There are training programs for certifications like real estate agents, fire safety managers, and nursing care assistants, but not all demand is focused solely on these areas.

FastCampus, like Coloso, is exploring international markets. While Coloso can engage in ‘one source, multi-use’ (expanding various businesses with a single piece of content), FastCampus has built a system to create successful content by leveraging over 10 years of experience in the adult education market. We can take this knowledge and develop content tailored to local needs. We’ve been experimenting with this in Indonesia for the past couple of months.”