August 27, 2020 — FastCampus, a leading South Korean adult education startup (CEO Kangmin Lee), announced today that it has surpassed 80 billion KRW in cumulative sales, achieving this milestone just six years after its establishment.

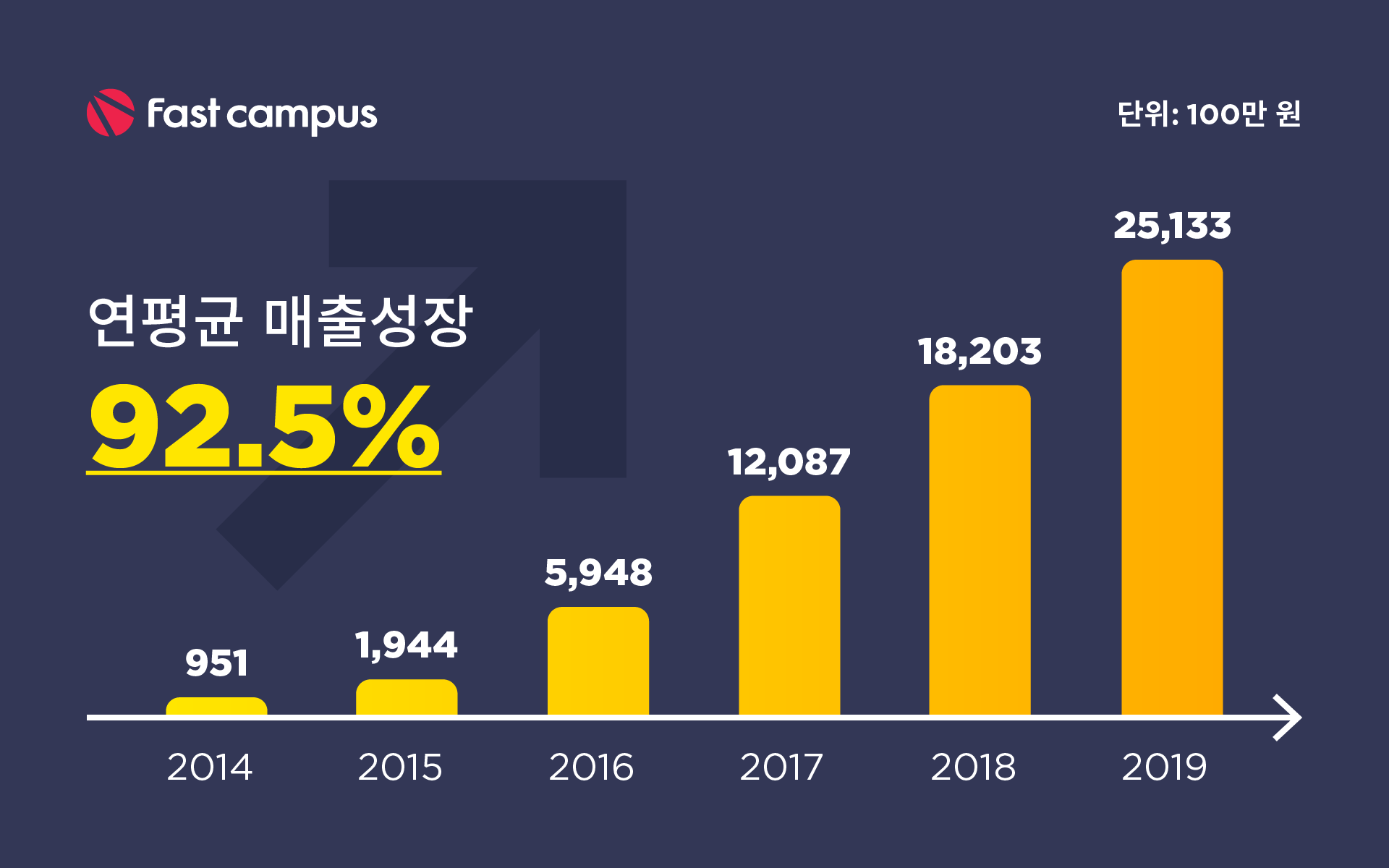

FastCampus began in 2014, offering part-time offline courses targeted at working professionals. By June 2020, the company recorded that 82% of its sales came from online offerings, expanding its library of offline content into the online and corporate education sectors. By mid-2020, FastCampus had reached 18 billion KRW in sales and achieved an average annual growth rate of 92.5%, reflecting strong demand from its customers.

FastCampus has solidified its position as a leader in the adult education market, providing content across a wide range of subjects. Its core offerings focus on digital skills such as marketing, design, and finance. The company has also expanded its educational services to self-employed professionals through its Coloso brand, offering courses in hairdressing, cooking, baking, photography, and more. Additionally, it provides foreign language education, covering English, Chinese, Japanese, French, and Spanish, among others.

In 2020, FastCampus more than doubled the number of courses available, growing from 120 to over 250, and increased its development workforce by 2.4 times. Despite this rapid expansion, the company continues to achieve monthly profitability, driven by growing demand from customers. FastCampus is particularly focused on further investment in content production for high-demand fields like data science, programming, creative industries, and foreign languages.

CEO Kangmin Lee commented, “FastCampus has successfully expanded from offline to online, and our efforts to provide the content our customers want have enabled us to achieve both growth and profitability. We are committed to continuously improving our content and investing in technology to deliver the best possible customer experience.”

Meanwhile, in April 2020, FastCampus selected Mirae Asset Daewoo and Samsung Securities as its lead and joint underwriters for an initial public offering (IPO), marking the start of its listing preparations.