FastCampus Surpasses KRW 3 Billion in Monthly Sales and Turns Profitable in Q1 2020

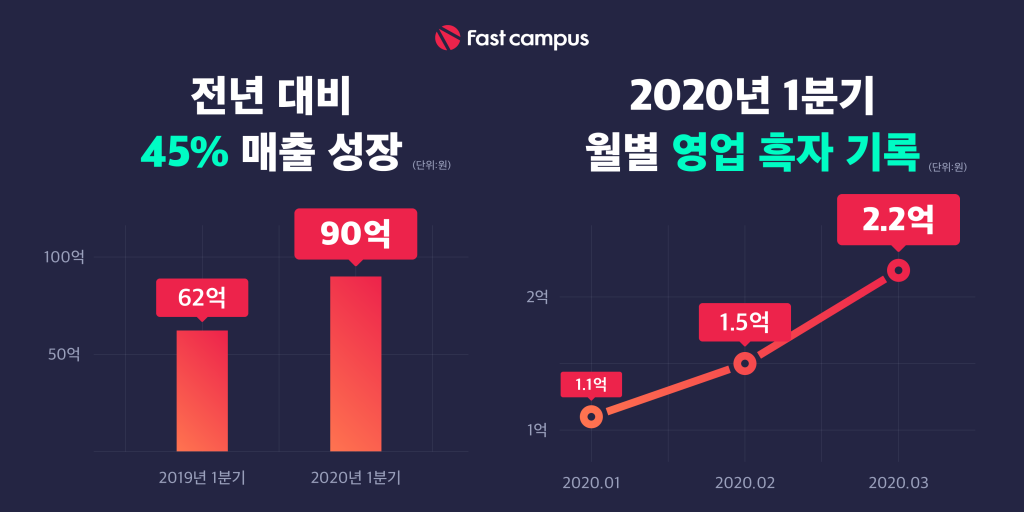

- Achieves KRW 9 billion in revenue in Q1 2020, marking over 45% growth compared to the same period last year

- Records three consecutive months of operating profit, proving profitability

May 11, 2020 — FastCampus, a leading South Korean adult education startup (Co-CEOs Jiwoong Park and Kangmin Lee), announced today that it has surpassed KRW 3 billion in monthly sales and achieved its first profitable quarter in Q1 2020.

FastCampus began in 2014 by offering part-time offline courses for working professionals. It became an independent entity in 2017 and has since reached a cumulative revenue of KRW 70 billion and over 200,000 enrolled students as of April 2019. The company has expanded its offerings to include digital skills such as data science, programming, marketing, design, and finance, as well as vocational skills through its Coloso brand, targeting self-employed individuals with courses in hairdressing, cooking, baking, photography, and more. Additionally, FastCampus offers foreign language education, including English, Chinese, Japanese, French, and Spanish, covering almost all educational content needed for adults post-graduation.

In Q1 2020, FastCampus exceeded KRW 9 billion in sales, achieving over 45% growth year-over-year. The company recorded three consecutive months of operating profit from January to March, demonstrating its profitability. FastCampus attributes this success to the robust content library built from its experience launching approximately 1,000 offline courses in its early years. This extensive content was expanded online and into corporate education, leading to a virtuous cycle of growth and profitability.

FastCampus CEO Kangmin Lee commented, “FastCampus started with offline courses and expanded online over the past six years, focusing on creating content that our customers truly want. While we’ve turned profitable in Q1, our focus is not just on profitability itself but on aggressively investing in better customer experiences and content that customers seek.”

In April 2020, FastCampus selected Mirae Asset Daewoo and Samsung Securities as its lead and joint underwriters, respectively, for its initial public offering (IPO), signaling the start of its preparations for a public listing.